Filed under: Uncategorized | Tags: Americans, climate change, driving, energy, energy consumption, gas prices, pollution, transportation, USA, vehicle miles traveled, Vmt

After a few years of sweet reversal of the VMT (Vehicle Miles Traveled) chart, then a few years of bouncing along what looked like a New Normal, things have turned around in a big way. Cheap gas being the primary culprit. Back to our old ways just like that, and making up for lost time.

http://www.fhwa.dot.gov/policyinformation/travel_monitoring/15augtvt/figure1.cfm

Filed under: Uncategorized | Tags: butane, energy, gas prices, gasoline, NGLs, RVP, transportation, vapor pressure

Blending butane into gasoline is why gas prices fall in the fall, according to Robert Rapier. RVP = Reid vapor pressure, the higher the RVP the faster the evaporation. EPA sets limits on RVP of gasoline which are more stringent in summer months than in winter, allowing the increased blending of cheap, yet highly evaporative (word?) butane:

Butane has an RVP of 52 psi, which means pure butane is a gas at normal pressures and temperatures. But butane can be blended into gasoline, and its fractional contribution to the blend roughly determines its fractional contribution to the overall vapor pressure of the mixture. As long as the vapor pressure of the total blend does not exceed normal atmospheric pressure (again, ~14.7 psi) then butane can exist as a liquid component in a gasoline blend.

But with a vapor pressure as high as 52 psi, butane can’t make a large contribution to summer blends where the vapor pressure limit is 7.8 psi. For example, if a gasoline blend contained 10 percent butane, butane’s contribution to the vapor pressure limit is already 5.2 psi and you would still have 90 percent of the blend to go. It isn’t feasible to blend much butane into gasoline when the vapor pressure requirement is low. But when the limit increases by 5 or 7 psi, it becomes feasible to blend large quantities of butane.

Why do we care about blending butane anyway? Because it is abundant and cheap. Butane can routinely trade at a $1/gallon discount to crude oil or gasoline. Butane is a byproduct of oil refining, but is also a component of natural gas liquids (NGLs), which are condensed out during natural gas production. Given the huge expansion of natural gas production in the US, it should come as no surprise that NGL production is also on the rise.

via Why Gasoline Prices are Falling.

Filed under: Uncategorized | Tags: 4th Amendment, energy costs, gas prices, Mark Udall, oil production, Randy Udall, Wyden

“Our people want to know why the flood of new domestic crude oil isn’t lowering prices at the pump,” said Ron Wyden, an Oregon Democrat and chairman of the Senate Energy and Natural Resources Committee. “There is no question that the lower oil costs are not getting through to Americans’ wallets.”

via Senators Grill Refiners Over High Prices Amid Oil Boom – Bloomberg.

If Wyden is this clueless about energy — what “lower oil costs”? — it does not give a fellar confidence that he is an effective guardian of civil liberties (Wyden is on the Senate Intelligence Committee which is supposedly a check on the executive branch’s surveillance fetish). Is he just trying to get someone from the industry to admit the truth, or is he really that out of it.

Filed under: Uncategorized | Tags: energy, fuel prices, gas prices, gasoline, pain at the pump, petrol

The long view.

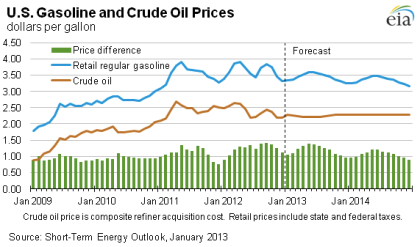

Filed under: Uncategorized | Tags: 2013 oil price, Brent, crack spread, crude oil, EIA, energy, gas prices, oil price predictions, refinery profits, transportation, WTI

Always kind of funny. Flat-line forever.

Filed under: Uncategorized | Tags: boehner, congress, energy, gas prices, Mitch McConnell, peak oil, reid, SPR, strategic petroleum reserve

And that leaves me in weird agreement with Mitch McConnell, one of the most objectionable individuals in the entire den of thieves on Capitol Hill:

“The [SPR] is there for an emergency situation. You have to ask the question: If there were release from the [SPR], would it have the desired effect, and how long would it have the desired effect?” McConnell said.

via Worried Dems pressing Obama on gas prices – TheHill.com.

Filed under: Uncategorized | Tags: Brent, crack spread, crude oil and gasoline prices, energy, fuel prices, gas prices, James Hamilton, oil price, peak oil, petrol, petroleum, WTI

My rule of thumb has been that for every $1 increase in the price of a barrel of crude oil, U.S. consumers are likely to pay 2-1/2 more cents for a gallon of gasoline.

Hamilton points to the lack of adequate pipeline infrastructure in the US to explain the gap between Brent and WTI.

via http://www.econbrowser.com/archives/2012/02/crude_oil_and_g.html

Filed under: Uncategorized | Tags: albatross, Brent, crude oil, fuel costs, gas prices, gasoline, Jevon's Paradox, Peak Demand, Peak Everything, peak oil, vehicle miles traveled, Vmt, WTI

VMT (Vehicle Miles Traveled) up slightly in December relative to last December, but down overall for the year, and below its previous peak now for 49 months. With fuel prices on the rise it doesn’t look like it will break above that for quite some time — if ever.

But what do I know.. People are buying cars again. It’s Halftime in America and “the SUV is back.”

From the DOT:

Filed under: Uncategorized | Tags: AAA, energy, fuel gauge report, fuel prices, gas prices, gasoline, Hubbert's Peak, peak oil

Filed under: Uncategorized | Tags: energy, gas prices, january 2012 gas prices, oil consumption, oil demand, peak oil

From Zero Hedge: http://www.zerohedge.com/news/january-gas-prices-all-time-highs

Filed under: Uncategorized | Tags: energy, energy consumption, gas prices, liquid fuel, oil, peak oil, refineries, U.S. average gas price

Via Calculated Risk.

We almost always ramp up the price in the spring.

Filed under: Uncategorized | Tags: consumption, England, fuel costs, gas prices, Great Britain, imports, petrol, Vmt

Drivers cut short journeys by 165 miles to beat fuel costs – Telegraph.

The headline of the article (concerning ‘the Why’) is an editorialization not entirely supported by the facts within it. Interesting.

Filed under: Uncategorized | Tags: exports, gas prices, Iran, oil, oil supply, OPEC, petroleum, Senate, war

Iran Faces Oil Curbs as U.S. Targets Central Bank While EU Adds Sanctions – Bloomberg.

I don’t know if these guys realize. Iran produces a lot of oil, and exports about 2.2 million barrels per day. This is a very strange/interesting development. “Choking off” Iranian exports will not only send prices to the stratosphere here, but could also cause very serious supply disruptions around the world, gas lines, rationing, general chaos. Now why would they want to do that?

Filed under: Uncategorized | Tags: China, energy, gas prices, Natural Born Drillers, oil prices, Paul Krugman, peak oil

…Although he does make other good points, like Yergin, in service of his argument of the day.

…Oil prices are up because of rising demand from China and other emerging economies, and more recently because of war scares in the Middle East; these forces easily outweigh any downward pressure on prices from rising U.S. production.

via Natural Born Drillers – NYTimes.com.