Filed under: Uncategorized | Tags: "shutdown", EIA, energy, government shutdown, oil, oil prices

Leaving a void of energy propaganda.

Impact of the federal government shutdown on EIA ›

As a result of the lapse in appropriations for the U.S. Energy Information Administration, the EIA.gov website and our social media channels will not be updated after 1:00 p.m. Eastern Time on Friday, October 11, 2013. Transactions submitted via the website might not be processed until appropriations are enacted; databases might not be available; and we will not be able to respond to inquiries.

Will the shutdown affect EIA\’s reports and data releases? Yes. The release of all reports and data will cease during the shutdown.

via U.S. Energy Information Administration (EIA).

Filed under: Uncategorized | Tags: crude oil, demand, EIA, energy, energy use, gasoline, jet fuel, oil consumption, Peak Demand, peak oil, products supplied, US oil consumption

Via EIA Week in Review.

Total products supplied over the last four-week period averaged about 19.7 million barrels per day, up by 3.7 percent from the same period last year. Over the last four weeks, motor gasoline product supplied averaged over 9.0 million barrels per day, up by 3.3 percent from the same period last year. Distillate fuel product supplied averaged 4.0 million barrels per day over the last four weeks, up by 11.1 percent from the same period last year. Jet fuel product supplied is 1.6 percent higher over the last four weeks compared to the same four-week period last year.

Filed under: Uncategorized | Tags: deepwater drilling, EIA, fracking, IEA, liquid fuel production, oil price, oil price predictions, oil production, Peak Demand, peak oil, refinery gain, shale oil, tight gas, tight oil

Via Kurt Cobb in the CS Monitor:

Back in the year 2000, the IEA divined that by 2010, liquid fuel production worldwide would reach 95.8 million barrels per day (mbpd). The actual 2010 number was 87.1 mbpd. The agency further forecast an average daily oil price of $28.25 per barrel (adjusted for inflation). The actual average daily price of oil traded on the New York Mercantile Exchange in 2010 was $79.61

[…]

So, what made the IEA so sanguine about oil supply growth in the year 2000? It cited the revolution taking place in deepwater drilling technology which was expected to allow the extraction of oil supplies ample for the world’s needs for decades to come. But, deepwater drilling has turned out to be more challenging than anticipated and has not produced the bounty the IEA imagined it would. …

via When oil forecasts get it wrong – CSMonitor.com.

Filed under: maps, Uncategorized | Tags: crude oil supply, Cushing, EIA, energy, oil pipelines, oil transportation, petroleum products, pipeline map, refineries, US oil production, WTI

Via EIA:

This Week In Petroleum Summary Printer-Friendly Version.

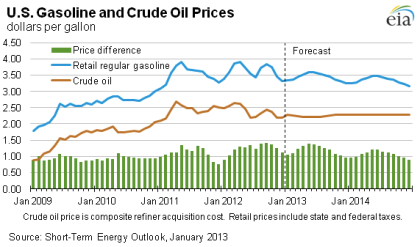

Filed under: Uncategorized | Tags: 2013 oil price, Brent, crack spread, crude oil, EIA, energy, gas prices, oil price predictions, refinery profits, transportation, WTI

Always kind of funny. Flat-line forever.

Filed under: Uncategorized | Tags: 2012, 2019, AEO table browser, EIA, energy, Hubbert, oil predictions, oil production, peak oil, U.S. crude oil production

7.54 mbd of crude in 2019. According to the EIA’s “AEO Table Browser:”

AEO Table Browser – Energy Information Administration.

See also: THE AMAZING RED MOUND, BAKKEN DEVELOPMENT BY COUNTY, EPA FRACKING AIR POLLUTION RULES, MONTANA CRUDE OIL PRODUCTION, LIVESTOCK IN FRACKING REGIONS

Filed under: Uncategorized | Tags: Bakken, bakken formation, EIA, Montana, Montana oil production, North Dakota, tight gas, tight oil

Appears to have peaked. See, the Bakken formation is in Montana and North Dakota.

via EIA: http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=pet&s=mcrfpmt2&f=m

Filed under: Uncategorized | Tags: 2012, disruptions, EIA, emergency survey, fuel shortages, gas, gas lines, gas rationing, gasoline shortage, New York City, power outages, Sandy, transportation

via EIA: http://www.eia.gov/special/disruptions/hurricane/sandy/gasoline_updates.cfm

Filed under: Uncategorized | Tags: cars, EIA, energy, Energy Information Association, gas stocks, gasoline, stocks, transportation

U.S. stocks of finished gasoline, via EIA.

Filed under: Uncategorized | Tags: China, Chinese coal production, climate, CO2 production, coal, EIA, energy, global coal production, global warming, peak oil

The rise in global production over the past decade is almost entirely due to Chinese production…

via the EIA via http://www.theoildrum.com/node/9485

Filed under: Uncategorized | Tags: ASPO, crude oil production, EIA, energy, Jeffrey Brown, oil production propaganda, peak oil, production numbers, Railroad Commission of Texas, RRC, Texas, Texas crude oil production, transportation

According to the Railroad Commission of Texas.

http://www.rrc.state.tx.us/data/production/oilwellcounts.php

Some individuals recently noting the difference between RRC and EIA production numbers. From a comment by Jeffrey Brown:

Total US Crude Oil Production (EIA, mbpd):

2002: 5.746

2003: 5.681

2004: 5.419

2005: 5.178

2006: 5.102

2007: 5.064

2008: 4.950

2009: 5.361

2010: 5.476

2011: 5.662Total US Crude Oil Production, using RRC data for Texas, instead of EIA (Gap Between the two data sets):

2002: 5.615 (+131,000 bpd)

2003: 5.548 (+133,000)

2004: 5.303 (+116,000)

2005: 5.059 (+119,000)

2006: 4.948 (+154,000)

2007: 4.898 (+166,000)

2008: 4.813 (+137,000)

2009: 5.199 (+162,000)

2010: 5.285 (+194,000)

2011: 5.324 (+338,000)

http://www.theoildrum.com/node/9191#comment-893345

Filed under: Uncategorized | Tags: crude oil, EIA, energy, Iran oil production, Iraq, middle-east, oil production, oil supply, peak oil, Peak Oil is dead, pipeline problems, Turkey

A new fire in the North Sea; blowout in Russia; hacking in Iran; pipeline problems in Turkey; accelerated violence in South Sudan… What I miss?

Filed under: Uncategorized | Tags: Bakken, Daniel Yergin, depletion, EIA, IHS CERA, Iran, Iran sanctions, oil predictions, oil supply, oil supply predicitons, peak oil, shale oil, The Yergin Gap, tight oil

Everything Yergin says here is true. He gives the impression of someone who chooses his words carefully. He won a Pulitzer and wrote two giant books about oil. But he somehow always leaves out half the story. Just doesn’t get it or pretends it doesn’t exist.

Yergin is a self-described optimist who believes human ingenuity (and higher prices) will produce as much oil as mankind would ever want or need. Like many of his ilk, he emphasizes various sources of supply that are on the verge of coming on line, and new sources of supply like the Bakken that are adding to existing supply. He mentions “disruptions” in supply, and indeed there are many of those. Disruptions are always on the verge of being restored to their rightful levels, you see. What he and his cornucopian brethren never mention is the ongoing natural depletion of existing giant oil fields. And his predictions never seem to take this depletion into account — which means his predictions (and those of his firm IHS CERA) have been absolutely laughable. I mean, they will make you lol those old predictions. The existing world of oil makes a lot more sense if you take into account the phenomenon of depletion; unfortunately the future looks a lot more bleak.

“Pulitzer Prize-winning Daniel Yergin” gets trotted out repeatedly, because his blind spot on depletion is quite useful to the contingent that thrives on the false belief that excessive regulation is throttling production in the US. And there is oh so much cash behind that fakery. Yergin’s paycheck depends on his not acknowledging depletion. The whole circus is really quite shameful, isn’t it?

Here he is in the WSJ optimistically listing factors that could keep the price of oil down, counteracting tensions with Iran. Optimism! Let’s see: New supply in the US, and various potential new sources of supply around the world. Check. Also, reductions in demand. Check. He doesn’t mention that “new supply” would have to amount to a Saudi Arabia’s worth every few years just to make up for ongoing depletion. In fact, he doesn’t mention depletion at all. Well done, Daniel.

New petroleum supplies could come into the market over the year from a variety of sources—from Iraq and Angola to Libya and Colombia. And notably, 300,000 barrels per day or more from the United States—primarily from North Dakota and Texas and from a rebound in off-shore production.

The other offset could come from reductions in demand. U.S. gasoline consumption so far this year is down over last year. China’s new economic growth target of 7.5%—down significantly from the 10% or so of recent years—would mean lower growth in its petroleum consumption. Of course, a rebound in global economic growth would increase demand, not only in China but in the U.S., Japan and Europe.

via Daniel Yergin: What's Behind Rising Gas Prices? – WSJ.com.

Filed under: Uncategorized | Tags: cabotage, east coast refineries, EIA, impact of refinery closures, Jones Act, refineries, refinery closures, tankers

The little-known Jones Act. Via the EIA’s report on potential refinery closure impacts: http://www.eia.gov/analysis/petroleum/nerefining/update/pdf/neprodmkts.pdf

(The impact of refinery closures, by the way: Potential short-term supply disruptions and price spikes, due to transportation and other logistical issues. It’s not that there won’t be enough gasoline, there just might not be enough for a while in those places that used to be supplied by the shut refineries. Then, those supply networks are developed and those problems ease, although longer supply lines may add some to the final retail price.)

Filed under: Uncategorized | Tags: Brent, crude oil, crude oil prices, EIA, energy, Energy Information Administration, NYMEX, oil price, oil price predictions, oil prices, peak oil, WTI

Via http://www.eia.gov/forecasts/aeo/er/early_prices.cfm

Consider in light of their historical track record, which has … not been good.

Filed under: Uncategorized | Tags: EIA, energy, historic price predictions, make-a me laugh, oil price predictions, peak oil, petroleum, Super Wrong, wrong

This was the EIA’s thought on future oil prices just nine years ago:

From an article on EIA predictions at Seeking Alpha: http://seekingalpha.com/article/363431-flawed-oil-forecasts-hide-continued-upward-pressure-on-prices

Filed under: Uncategorized | Tags: cost per foot, drilling costs, drilling rigs, EIA, energy, oil production costs, peak oil, production costs

Cost per foot of oil wells, United States. Stunning chart.

From EIA: http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=E_ERTWO_XWPN_NUS_DF&f=A

Filed under: Uncategorized | Tags: BP, Chevron, EIA, Exxon, Exxonmobil, Koch Industries, Marathon, oil refineries in the US, Premcor, refineries, refinery throughput, Suncor, Sunoco, Tesoro, US refineries, Valero

Top U.S. Refineries – Energy Information Administration. Energy Rankings.

Filed under: Uncategorized | Tags: Brent, crude oil prices, Cushing, EIA, feedstock, refineries, refinery, refinery acquisition costs, This Week in Petroleum, US refineries, WTI

The cost of the raw material varies greatly around the country. This is the featured chart on EIA’s This Week in Petroleum.

Filed under: Uncategorized | Tags: demand, EIA, energy, gas consumption, gasoline, oil demand, peak oil, recession, This Week in Petroleum, transportation

From EIA’s This Week in Petroleum.