Filed under: Uncategorized | Tags: Chevron, crude oil, energy, Exxon, fracking, James Hamilton, oil, oil production, peak oil, Royal Dutch Shell, Shell, WSJ

via James Hamilton via WSJ: http://econbrowser.com/archives/2014/01/big-oil-companies-spending-more-and-producing-less

Filed under: Uncategorized | Tags: crude oil, demand, EIA, energy, energy use, gasoline, jet fuel, oil consumption, Peak Demand, peak oil, products supplied, US oil consumption

Via EIA Week in Review.

Total products supplied over the last four-week period averaged about 19.7 million barrels per day, up by 3.7 percent from the same period last year. Over the last four weeks, motor gasoline product supplied averaged over 9.0 million barrels per day, up by 3.3 percent from the same period last year. Distillate fuel product supplied averaged 4.0 million barrels per day over the last four weeks, up by 11.1 percent from the same period last year. Jet fuel product supplied is 1.6 percent higher over the last four weeks compared to the same four-week period last year.

Filed under: Uncategorized | Tags: crude oil, Egypt, energy, oil exports, oil production, peak oil

via Energy Export Databrowser:

Filed under: Uncategorized | Tags: Brent, crude oil, Cushing, energy, Keystone pipeline, North Sea, oil prices, WTI

West Texas Intermediate crude became more expensive than Brent for the first time in almost three years as pipeline and rail shipments helped clear a bottleneck that reduced the price of the U.S. benchmark.

WTI hadn’t been higher than Brent since Aug. 17, 2010. The move was in intraday trading. WTI averaged $17.47 less than Brent in 2012 and traded as much as $23.44 lower than its European counterpart Feb. 8.

Improved pipeline networks and the use of rail links are helping to ease the North American oil glut created by rising production of crude from shale formations. WTI has jumped 18 percent this year, while Brent has decreased 2.5 percent as North Sea supplies stabilized after maintenance.

via WTI Crude Exceeds Brent for First Time in Almost Three Years – Bloomberg.

Filed under: Uncategorized | Tags: Bakken, crude oil, energy, IEA, IEA forecast, OECD, oil price predictions, oil supply, OPEC, peak oil, refining capacity, shale oil, tight oil

IEA… Not a good track record with the predictions. Doesn’t stop ’em from throwing out new crazy numbers every year.

While geopolitical risks abound, market fundamentals suggest a more comfortable global oil supply/demand balance over the next five years. The MTOMR forecasts North American supply to grow by 3.9 million barrels per day (mb/d) from 2012 to 2018, or nearly two-thirds of total forecast non-OPEC supply growth of 6 mb/d. World liquid production capacity is expected to grow by 8.4 mb/d – significantly faster than demand – which is projected to expand by 6.9 mb/d. Global refining capacity will post even steeper growth, surging by 9.5 mb/d, led by China and the Middle East.

via IEA – May:- Supply shock from North American oil rippling through global markets.

Filed under: Uncategorized | Tags: ANE, China, China oil consumption, China oil imports, Chindia, crude oil, peak oil, The Yergin Gap, westtexas, Yergin

“China is importing an increasing amount of crude, which is the most crucial issue for the country’s energy supply,” said Zhang during the Boao Forum for Asia Annual Conference

And the most crucial issue for the world’s energy supply too.

One way to look at it is that we in the west are being outbid by people in Asia for available oil exports. The price is high because if it were any lower people would want to consume more than can currently be produced.

via China depends more on overseas oil |Economy |chinadaily.com.cn.

Filed under: maps | Tags: bitumen, crude oil, Enbridge, environment, Exxon, oil sands, oil spill, oil transportation, pegasus, pegasus line, pipeline rupture oil, tar sands

The Pegasus line through Arkansas is spewing its contents into a subdivision.

Filed under: Uncategorized | Tags: Brent, crude oil, Cushing, James Hamilton, peak oil, Seaway pipeline, spread, WTI

Blue is Brent, black is WTI, green is the spread between them.

A relatively recent phenomenon explained by James Hamilton:

West Texas Intermediate is a particular grade of crude oil whose price is usually quoted in terms of delivery in Cushing, Oklahoma. Brent is a very similar crude from Europe’s North Sea. As similar products, you’d expect them to sell for close to the same price, and up until 2010 they usually did. But an increase in production in Canada and the central U.S. combined with a decrease in U.S. consumption has led to a surplus of oil in the central U.S. This overwhelmed existing infrastructure for cheap transportation of crude from Cushing to the coast, causing a big spread to develop between the prices of WTI and Brent.

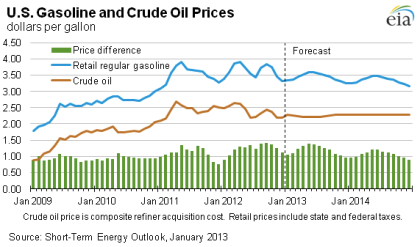

via Econbrowser: Prices of gasoline and crude oil.

Filed under: Uncategorized | Tags: 2013 oil price, Brent, crack spread, crude oil, EIA, energy, gas prices, oil price predictions, refinery profits, transportation, WTI

Always kind of funny. Flat-line forever.

Filed under: Uncategorized | Tags: Asjylyn Loder, Bakken, cornucopianism, crude oil, fracking, hydraulic fracturing, lies about fracking, Marcellus, North Dakota, oil extraction, peak oil, PR, propaganda, shale oil, techno-worship, technology, tight gas, tight oil, United States oil production

America’s latest oil rush was spurred by new technology that has made drilling faster, cheaper and better at unleashing oil from rock formations,…

That is false. Fracking (the oil guys always called it ‘fracing’) is old technology. Many decades old. But it’s an expensive way to get oil, relatively speaking. So it hasn’t been prudent to frack/frac for shale oil until the overall situation reached a certain point where the price of a barrel of crude was likely to remain above the cost of extraction. In other words, the fracking boom in the U.S. does not signal the death of Peak Oil. It is in fact part and parcel of a new era wherein cheap oil is a memory, a much more expensive era in energy. Perhaps that is why the misinformation campaign has been in overdrive.

via Asjylyn Loder, “American Oil Growing Most Since First Well Signals Independence,” Bloomberg..

Spreading disinformation through the media is even older technology.

Filed under: Uncategorized | Tags: Bakken, crude oil, demand destruction, energy, fracking, IEA, KSA, mbd, oil consumption, oil production, Our Finite World, refinery gain, Saudi Arabia, Saudi Arabian oil production, shale gas, shale oil, tight gas, tight oil, Tvberg, Tverberg, unconventional oil, US oil production, WEO, World Energy Outlook

The happy talk on future production is crazier than ever in the latest IEA World Energy Outlook, but there are also some stunningly pessimistic predictions buried inside. Wild!

For instance: The US will become number one oil producuh again and rediscover our lost oil-producing prowess with about 11 million barrels/day (Yay!) — which must mean Saudi Arabia won’t approach IEA’s previous prediction for that country of roughly 15 mbd output (Ooof). And the predicted exporter status of the US (Yay!) relies as much on a huge drop in consumption as it does on increases in production (Ooof). So it’s a bit of a sad day in IEA land, where consumption always went up, up, up.

From Tverberg:

The International Energy Agency (IEA) provides unrealistically high oil forecasts in its new 2012 World Energy Outlook (WEO). It claims, among other things, that the United States will become the world’s largest oil producer by 2020, and will become a net oil exporter by 2030.

Figure 1. Author’s interpretation of IEA Forecast of Future US Oil Production under “New Policies” Scenario, based on information provided in IEA’s 2012 World Energy Outlook.

Figure 1 shows that this increase comes solely from the expected rise in tight oil production and natural gas liquids. The idea that we will become an exporter in later years occurs despite falling production, because “demand” will drop so much.

Note that IEA and other maniacs add NGLs, biodiesel and even ‘refinery gain’ to the US oil production number, in a crude attempt to fool y’all.

Filed under: maps | Tags: aircraft carriers, amphibious warship, crude oil, en route, energy, Iran, middle-east, Persian Gulf, Strait of Hormuz, the Great Game

via http://www.zerohedge.com/news/three-us-aircraft-carriers-now-middle-east-fourth-en-route

Filed under: Uncategorized | Tags: crude oil, demand growth, demand plateau, energy, OECD, oil consumption, oil demand, oil demand forecast, OPEC, Peak Demand, peak oil

Interesting times.

“Demand in the OECD is in structural decline and we’re not expecting that to change,” he said, adding that the IEA’s forecasts do take into account recent weaker economic activity in the Asia-Pacific region.

According to the report, which contains the IEA’s first forecasts for 2013, global oil demand will be 1.1% higher than 2012, averaging 90.9 million barrels a day.

The forecasts are more bullish than reports earlier this week from the U.S. Energy Information Administration and the Organization of Petroleum Exporting Countries, both of whom projected slower global oil demand growth in 2013 of 730,000 barrels a day and 800,000 barrels a day respectively.

via RIGZONE – IEA: 2013 Oil Demand Growth Higher On Muted Recovery.

Filed under: Uncategorized | Tags: American oil production, crude oil, crude oil production, Econbrowser, energy, James Hamilton, oil production, peak oil, Texas oil production, Texas Railroad Commission, tight oil, transportation, westtexas

A historical perspective.

via Econbrowser and James Hamilton: http://www.econbrowser.com/archives/2012/07/shale_oil_and_t.html

Filed under: Uncategorized | Tags: Bakken, Bakken Shale, crude oil, energy, horizontal drilling, James Hamilton, Jeffrey Brown, marginal costs of production, natural gas liquids, Niobrara, oil price, oil shale, peak oil, shale oil, shale plays, tight gas, tight oil, tight oil formations, unconventional oil, westtexas

Throwing a little cold water on some recent, loudly reported unscientific predictions. When you read Hamilton, always be sure to read the comments by Jeffrey Brown for an important Big Picture view.

In addition to the uncertainties noted above about extrapolating historical production rates, the rate at which production declines from a given well over time is another big unknown. Another key point to recognize is the added cost of extracting oil from tight formations. West Texas Intermediate is currently around $85/barrel. With the huge discount for Canadian and north-central U.S. producers, that means that producers of North Dakota sweet are only offered $61 a barrel. Tight oil is not going to be the reason that we return to an era of cheap oil, for the simple reason that if oil again fell below $50/barrel, it wouldn’t be profitable to produce with these methods. Nor is tight oil likely to get the U.S. back to the levels of field production that we saw in 1970. But tight oil will likely provide a source of significant new production over the next decade as long as the price does not fall too much.

via Econbrowser: Shale oil and tight oil.

Filed under: maps | Tags: Arab Emirates, crude oil, crude pipeline, Emirates, energy, global crude oil, Habshan-Fujairah, Iran, middle-east, oil production, oil transport, peak oil, Persian Gulf, pipeline, Strait of Hormuz, UAE

Will help a little bit with the whole Strait of Hormuz thing.

Filed under: Uncategorized | Tags: crude oil, EIA, energy, Iran oil production, Iraq, middle-east, oil production, oil supply, peak oil, Peak Oil is dead, pipeline problems, Turkey

A new fire in the North Sea; blowout in Russia; hacking in Iran; pipeline problems in Turkey; accelerated violence in South Sudan… What I miss?

Filed under: Uncategorized | Tags: crude oil, oil production, oil supply, peak oil, Saudi Arabia, Saudi Arabian oil production, Schumer

But Senator — to what degree will desperate-sounding ‘comments’ from US officials like yourself counteract those hypothetical emphatic promises? Seems like Shoom is scrambling for relevance.

Schumer called on Saudi Arabia to repeat its intention to make up for supply losses, arguing the comments will drive down gas prices, which are tethered to global oil prices.

“If the markets believe this is real, the price will come down even further. So we are asking the Saudis to repeat this promise,” Schumer said.

“The more explicit they are, the more emphatic they are, the more they ensure the markets that they are for real here,” he continued, “the more the markets will calm down more permanently and the more the price will come down.”

via Schumer: Saudi Arabia's plan to increase oil supply will lower gas prices – The Hill's E2-Wire.

Filed under: Uncategorized | Tags: bitumen, Canada, crude oil, economic threshold, energy, marginal price, oil, oil sands, Suncor, syncrude, tar sands, unconventional oil

More commonly, less accurately known as oil sands.

From Canada’s Energy Future (pdf), a 2011 report from the National Energy Board.

The threshold will be highly dependent on the price of natural gas.

Filed under: Uncategorized | Tags: Brent, crude oil, crude oil prices, EIA, energy, Energy Information Administration, NYMEX, oil price, oil price predictions, oil prices, peak oil, WTI

Via http://www.eia.gov/forecasts/aeo/er/early_prices.cfm

Consider in light of their historical track record, which has … not been good.